Here we evaluate McDonald’s stock dividend as a viable investment opportunity. Do you think MCD stock is a must buy? Let’s dig in.

McDonald’s Stock Dividend Analysis: Is The Stock a Must-Buy?

Before we dive into our McDonald’s stock dividend analysis here are a few high-level themes of the stock and its valuation:

- Income investors should prioritize volatility reduction as well as dividend yield and dividend growth;

- 3M is my top pick of the dividend aristocrats as it better fits the aforementioned criteria;

- The second place among the selected goes to McDonald’s;

- Due to the low correlation of returns with the other stocks, McDonald’s should be in every income portfolio;

I created a book titled Dividend Investing Your Way to Financial Freedom to help you increase your income and build wealth at the same time.

If you want a sample of the book, you can download it here.

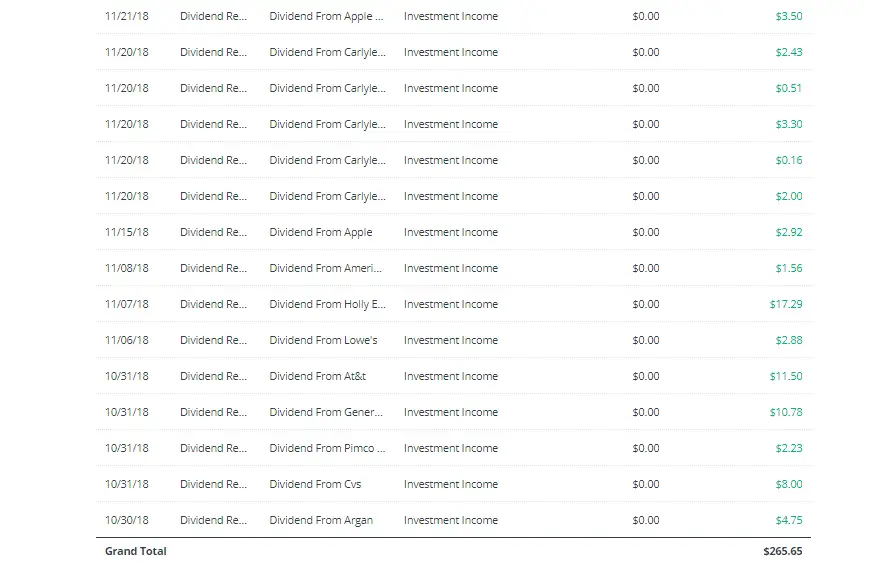

I believe that investing in dividend stocks enables you to increase your income and build perpetual wealth. It’s one of the few asset classes that enables you to do this. Real estate has similar characteristics, but it doesn’t have the same level of liquidity.

Investment Thesis in McDonald’s Stock Dividend

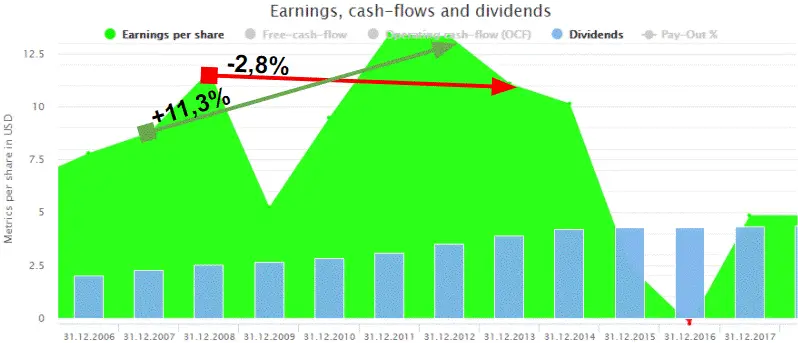

Income investors building a portfolio for retirement are usually looking for stocks to buy-and-hold thus they focus on dividend yield and dividend growth, disregarding capital gains for the most part.

As a dividend growth investor myself, I believe these investors should also consider dividend stability and stock price volatility. The importance of stable dividends is intuitive. The rationale for the importance of volatility is that although capital gains can be somewhat disregarded by investors who only seek a passive income, it’s very likely that they experience psychologic pressure from big losers.

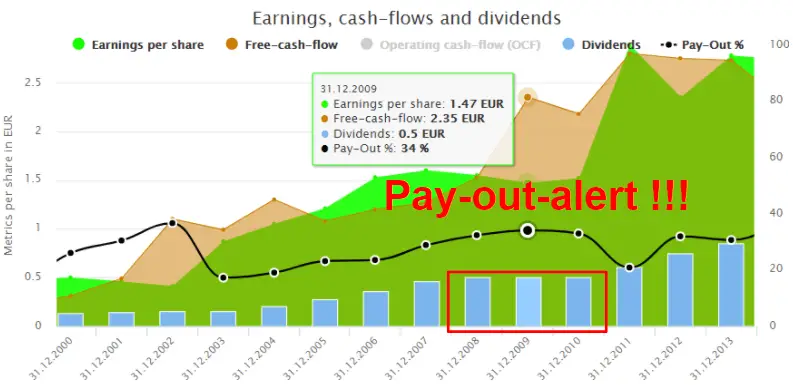

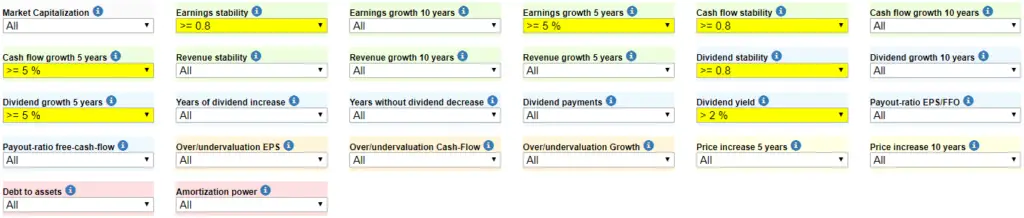

I decided to mimic the stock selection process considering all these criteria: Dividend Yield, Dividend Stability, Historical Dividend Growth (as a proxy for future growth) and Stock Price Volatility.

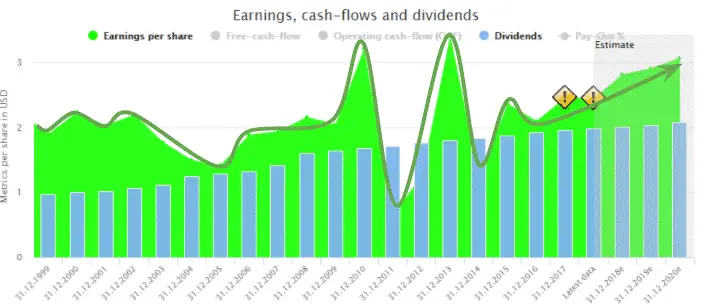

Giving special attention to the latter and including some qualitative insight I arrived at the conclusion 3M Company (MMM) is the best stock to own in a retirement portfolio.

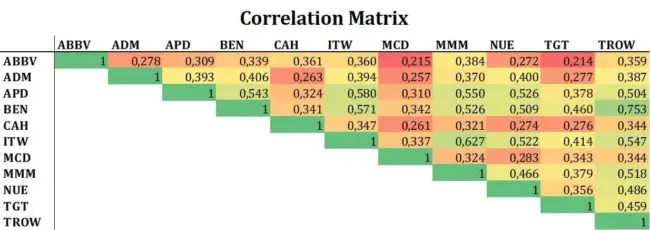

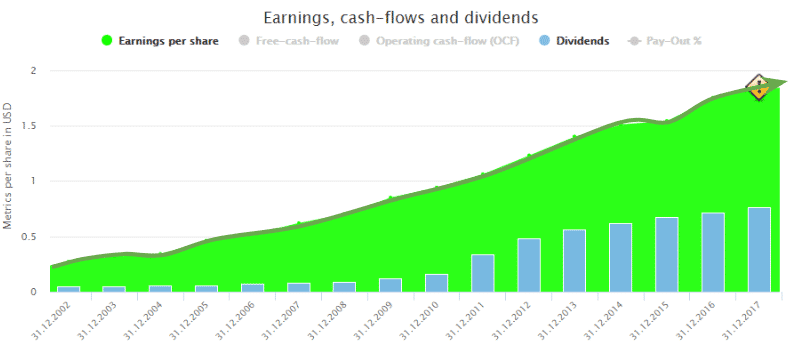

Additionally, I found that McDonald’s (MCD) share price returns have the lowest correlation not only with that of 3M Company but also with that of all other top dividend payers. In a 50/50 portfolio, MCD is always the best second choice to minimize volatility regardless of the first stock added to the portfolio.

Selection Process of McDonald’s

The base for the selection was the 2019 list of Dividend Aristocrats. Since it includes stocks that have been paying and growing dividends for at least 25 years, I believe this list is a good proxy for dividend stability.

To be in the list, the stocks also need to be in the S&P 500, which is a valuable criterion in terms of size and liquidity.

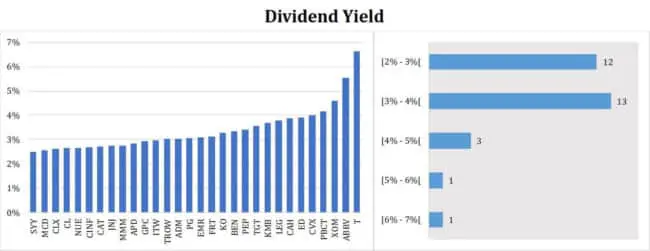

There are currently 57 stocks in that list so I started by selecting the top 30 with the largest dividend yields because this is the primary source of return for this type of investors. Beware of dividend yield because it isn’t always a good thing to have a higher yield. I’d rather rely on profit growth for my dividend investments.

In fact, we like to look for low dividend yielding stocks with a very high likelihood of increasing dividends in the future. No matter the economic conditions.

This was done using my FINVIZ premium screening. This is a must have for any investor. You can find so many new opportunities. There are a million ways to make money in the stock market.

All of the 30 stocks selected have a yield of 2.5% or more.

In the next step, I collected the annual growth rate of the dividends paid in the last 10 years (2008 – 2018) and discovered the average rate of dividend increase across these 30 stocks is 9%. Then I dropped the ones below the average and only 11 remained.

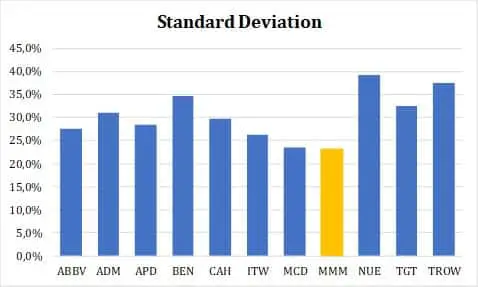

So now we have the top half dividend payers with above-average (and average) dividend growth. It’s time to check stock price volatility. Volatile stocks aren’t necessarily a bad thing. They can provide more opportunity.

I used the standard deviation of returns for that and this is what I got:

3M Company popped out as the one with the lowest volatility among peers, closely followed by McDonald’s.

That’s mostly why MMM is my top pick among the Aristocrats, but also because I believe that over the long term a lot of industry dynamics change dramatically, so it makes sense to add stocks with diversified business models with a global presence and strong track record. That’s 3M!

Building an Income Portfolio

The thing about building a portfolio under these circumstances is that the expected return is the dividend yield, and since I’ve selected my yield range already, I can now focus on minimizing volatility. I’ll do that following a mean-variance approach, although I won’t be solving the algorithm to find the allocations (I’ll leave that to another article).

Assuming a long position on 3M, what would be the best stock (among the other 10) to add to this retirement portfolio? That’s the question I wanted to answer.

In the process, I realized some of the stocks like Cardinal Health (CAH), AbbVie (ABB) and MCD had a particularly low correlation with all the others.

After computing the combinations, the best stock to combine with MMM was MCD. What’s more, if I started with any of the other stocks, MCD would still be the best stock to add in order to minimize portfolio volatility.

Hence the conclusion that McDonald’s is the second best stock to add to a dividend portfolio.

Considerations of McDonald’s Stock Price

This is a very simplistic approach to both stock picking and portfolio management. It is mostly designed to illustrate income investors should consider more than the dividend yield.

Ideally, stock selection would incorporate further business research and portfolio management would involve a proper implementation of the Modern Portfolio Theory. As an equity investor, you are lowest on the capital stack. Thus, you need to be aware that you are paid after taxes, debt investors, payroll. That is why equity investing has its risks.

At the same time, dividend investing has its rewards.

Why?

Dividend investing can provide a recovery of capital to investors through dividend payments while maintaining the same equity upside as growth stocks. In your eyes, what’s better dividends or growth?

The answer is both. You can capture both by investing in the right stocks.

Conclusion on McDonald’s Stock Dividend

I believe volatility should be considered by buy-and-hold income investors.

With that in mind and following a sequential analytical process, I concluded 3M Company is the best stock to own among dividend aristocrats, especially if you’re building a retirement portfolio or looking to earn some long-term passive income.

Additionally, I found that incorporating McDonald’s stock to any previous individual selection will reduce volatility, hence MCD is always the best second retirement stock.

What do you think of McDonald’s stock dividend? Please let me know in the comments below. I’d love to hear from you.

Related Resources:

- List of Dividend Kings

- Directory of No-Free Dividend Reinvestment Plan Stocks

- Free Downloadable Short-Form Dividend Discount Model

Subscribe to the Millionaire Mob early retirement blog newsletter to find the best travel hacking tips, dividend growth investing, passive income ideas and more. Achieve the financially free lifestyle you’ve always wanted.

Follow me on Facebook, Twitter and Instagram.

The post McDonald’s Stock Dividend Analysis: Is The Stock a Must-Buy? appeared first on Millionaire Mob.

from Millionaire Mob http://bit.ly/2BgDhcE

via IFTTT