If you are a big dividend growth investing fan like me, you must track your income on your dividend portfolio. Dividend income tracking software can save you time and money. Here is an overview of the top dividend income trackers you’ll need to follow your portfolio.

Top 5 Dividend Income Tracking Software You Must Use

Dividend income tracking software has become a mainstay for every dividend growth investor. Why? Well, seeing your dividend income roll in every day will motivate you to continually invest and put capital to work.

This will help you take advantage of compound interest. Every dividend income reinvestment (even on a small scale) will compound many years into the future.

If you want to invest your money effectively, you’ll need to know how an options trading strategy fits within your investing goals.

Millionaire Mob wrote a dividend investing book to help people get started investing.

The book is titled Dividend Investing Your Way to Financial Freedom and features a number of resources to help you invest for financial freedom, including:

- Improve your portfolio returns

- Understand the pros and cons of a dividend investing approach

- Develop and craft your own dividend investing strategy

- Build wealth through a long-term compound interest plan

If you want a sample of the book, you can download it here.

You can’t become a successful dividend investor if you aren’t working smarter. Let’s get into some amazing dividend investing tools to position you for success.

List of Best Dividend Income Trackers

Saving time and making smarter decisions is what we are all about. If you want to invest easy, you need to follow these trackers and set yourself up for time-saving success.

Let’s get into the best dividend income tracking software that you need to use for continued success.

1. Personal Capital

Personal Capital is the ultimate solution for any passive income and dividend income investor. The cash flow tracking on the platform is industry leading. I use this to track my net worth and all various passive income sources.

From a dividend perspective, I’ve linked all my retirement accounts (401k, Roth IRA, HSA) and my after-tax passive dividend income portfolio. I’ve been building this through Robinhood (get a free share of stock just by signing up!). If you want to try something different, these other brokerages are giving out free stock.

Personal Capital has the functionality to link up with Robinhood now. Personal Capital is one of those free dividend tracking programs that every dividend investor needs to have. All you have to do with Personal Capital is link your brokerage accounts and start monitoring. It’s as easy as that.

Here’s how I the Personal Capital software use it to track my dividend income.

First, I link up my Personal Capital account with Robinhood or whatever brokerage you use. It will gather and track as much data as possible.

Here you can see a snapshot of how my Robinhood investments look in Personal Capital.

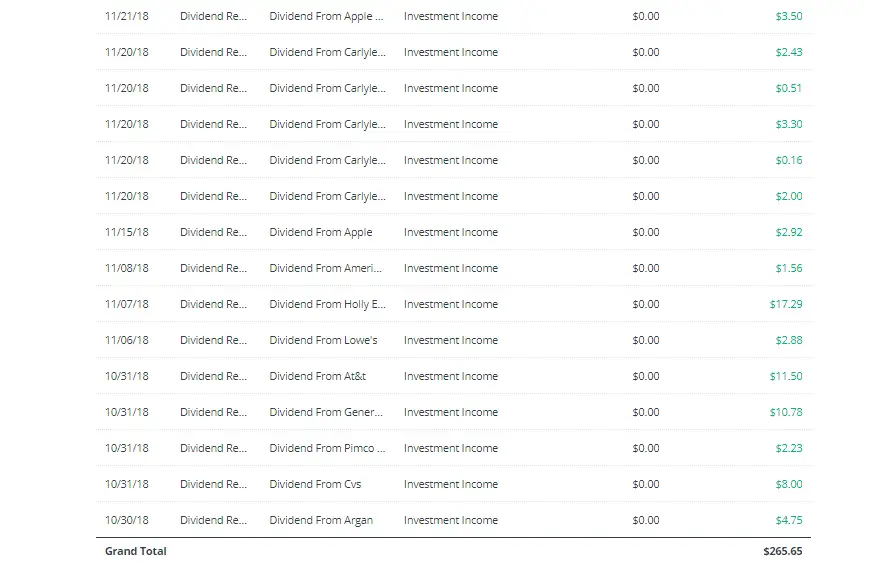

From there, go click on the income selection. Then, type in investment income in the search bar. Income always includes deposits in Personal Capital. We want only dividend income.

Keep in mind that you can change how you want to track in the income. You can do it on an annual, year-to-date, 30 days, 90 days, etc. Here is how much dividend income I’ve generated in the last 90 days.

So, I’ve generated $265.65 in dividend income in 90 days on Robinhood. Not bad for doing completely nothing. There’s nothing much better than receiving income on your investment portfolio. I can’t wait to reinvest all this income back into my dividend income portfolio!

2. Dividend.com

I think the name says it all. Dividend.com is everything dividends and dividend growth investing. You simply can’t go wrong with their platform.

Investors can use the Ex-Dividend Date Search tool to find the right stocks that are going ex-dividend during a specific timeframe. Ex-dividend dates are crucial in dividend investing because you must own a stock before its ex-dividend date to be able to receive the dividend payment.

3. Robinhood

Robinhood is actually pretty awesome for dividend tracking. I wrote about how dividends work on Robinhood because I believe a lot of people didn’t understand it. However, it’s actually pretty simple and straight forward to follow. Unlike other brokerages, dividends tend to be a black box for following them. In Robinhood, the history section will show upcoming and prior dividends.

You can stay on track with all your dividend payments as they come it. Sign up for Robinhood using my link and get a free share of stock.

4. Microsoft Excel

Good ole’ reliable. Microsoft Excel is proven, flexible and relies solely on data coming directly from the user. You can use this to simply input the amounts you find from your brokerage accounts. You can also use the current annual dividend yield to forecast out your dividends.

Don’t chase yield as a dividend growth investor. Stick with your guns of investing in stocks that have a high likelihood of keeping and increasing their dividend in the future.

I created a similar Excel sheet that helps you plan your forecasted dividend income. All you have to do is create a separate sheet and input your portfolio. You should let that flow through the forecast tab. This can be a great way to plan for a life of living off dividends.

Try downloading it using the button below. It only takes 5 minutes to punch in the assumptions.

Or, you can build a dividend tracker in Excel from scratch…

5. Finbox

Finbox (get $5 free with my link). Yes. Finbox is everything I’ve ever wanted as an investor. I remember back in investment banking I’d be armed with amazing tools like CapitalIQ, Pitchbook, etc. Those are very expensive. Finbox is free. You have to love that.

Okay, they might not be a full-blown free dividend income tracker. However, they arm you with the best tools for success including screeners, models, add-ons and so much more. With this software, you don’t need much else.

Keep quiet about them. It just seems too good to be true…

Conclusion on Dividend Income Tracking Software

A dividend income tracker can help you build a stable and effective portfolio. The software or model can help you save time on tracking the investments you already have and avoid any surprises in dividend cuts or outright removal of dividends.

Plus, I think there is a motivating factor by having a dividend income tracker. You can watch your income pile in and you know that you will have fresh capital to deploy into new or existing investments.

What are you waiting for? Start building a dividend portfolio now.

What do you think of these dividend portfolio trackers? Do you already use any dividend income tracking software? Let me know in the comments below. I’d love to hear from you!

Related Resources:

- List of Dividend Kings to Help You Invest

- List of No-Fee Dividend Reinvestment Plan (DRIP) Stocks

- Free Downloadable Dividend Discount Model

Subscribe to the Millionaire Mob early retirement blog newsletter to find the best travel hacking tips, dividend growth investing, passive income ideas and more. Achieve the financially free lifestyle you’ve always wanted.

Follow me on Facebook, Twitter and Instagram.

The post Top 5 Dividend Income Tracking Software You Must Use appeared first on Millionaire Mob.

from Millionaire Mob http://bit.ly/2MFu01Y

via IFTTT

No comments:

Post a Comment