Profit and earnings growth is paramount to a dividend investing strategy. Here’s why profit growth is so important with investing.

The Secret to Dividend Investing is Profit Growth [Here’s Why]

Growing dividends are the main motivation for many investors. Accordingly, most criteria for stock selection are dividend-focused. However, in the long run, reliable and growing dividends are only possible if company profits are reliable and growing as well.

Dividend history good – all good?

Nevertheless, long-term profit-growth is usually only of secondary importance when choosing dividend stocks. Popular terms like Dividend Aristocrats have no equivalent on the profit-growth side. At least I haven’t heard of profit aristocrats yet. I suppose there are two main reasons for this.

When I check Personal Capital, I’m able to see my various investments and cash flow for free. Use this tool to evaluate your income and investment diversification.

If you want to invest your money effectively, you’ll need to know how an options trading strategy fits within your investing goals. Millionaire Mob wrote a dividend investing book to help people get started investing.

The book is titled Dividend Investing Your Way to Financial Freedom and features a number of resources to help you invest for financial freedom, including:

- Improve your portfolio returns

- Understand the pros and cons of a dividend investing approach

- Develop and craft your own dividend investing strategy

- Build wealth through a long-term compound interest plan

If you want a sample of the book, you can download it here.

Why Everyone Should Consider a Dividend Growth Investing Strategy

First, dividends generate predictable cash-flow. The popularity of dividend calendars reflects the importance of this fact. The only alternative to creating cash-flow from your investment would be to sell some of your stocks, transforming a passive income investor into a small-size-trader, which is barely unacceptable for the majority.

Hence, without dividends, stocks would be of no interest to many investors. It, therefore, seems obvious to base the selection of stocks essentially on dividend-related criteria.

Second, the focus on dividends is based on the idea that dividends are predictable, contrary to a company’s profit and capital gains. Dividend aristocrats seem to have proven this, having successfully defied economic crises and price slumps by increasing dividends reliably over decades.

This explains the focus of many investors on the dividend history, while profit-growth as selection criteria is only included indirectly using snapshot-like metrics such as the payout ratio.

How Long-Term Profit Growth Pairs with Dividends

However, it is undeniable that long-term dividend increase must be financed by long-term profit increase. Consequently, companies with long-term profit increase, exist.

If we were able to identify these companies directly based on profit related metrics, we would no longer be dependent on dividend based metrics like the dividend history as an indicator of long-term profit-growth.

We could then even find promising dividend stocks that may not have a long dividend history because they just started paying dividends a few years ago or, in case of doubt, would rather keep the dividend constant than increase it by a symbolic cent.

Our expected yield would also increase since the overall yield on the stock market is composed of dividends plus capital gains for the dividend investor. The same goes for any other investor as well. At the end of the day, growing company profits in the long run always lead to capital gains. That is why I don’t always look at annual dividend yield when investing.

Then, the question arises of how long-term profit development is quantified.

Quantifying Long-term Profit Growth

There are several ways to quantify and analyze long-term profit growth in investing, not just a dividend growth investment strategy. You can evaluate profit growth through the compound annual growth rate of a company, profit stability and by analyzing both profit and growth together.

I love pairing together the quality of growing profits plus dividends in a dividend reinvestment plan. This helps ensure that I continue to take advantage of the compound interest snowball.

I build a dividend calculator to help you sensitize what it will take to live completely off dividends. It literally takes 5 minutes to input your plan.

The Compound Annual Growth Rate

It seems obvious to quantify long-term profit-growth on the basis of an average increase over several years. This is done by calculating the compound annual growth rate (CAGR). The problem is that the CAGR only takes into account the data points at the beginning and at the end of the period. Whether the quantified metric, e.g. profits, collapsed in the middle of the period or remained constant is irrelevant for the calculation result.

For companies with unreliable profit-growth, the growth rate becomes a matter of luck, changing dramatically from year to year.

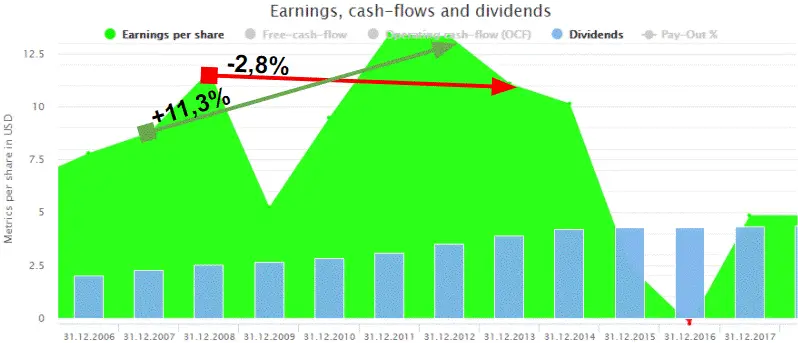

Chevron: The 5-year growth rates of profits are unreliable

Subsequently, the CAGR is inadequate for the search of companies with reliably profit-growths. A different metric is needed.

Profit Stability

Stable profit-growth means that profits have increased by a similar, predictable level each year. This can be quantified by calculating the correlation between time and profit evolution.

The result is a value between -1 to +1. A +1 stands for a perfect match between time and profits. At +1, the profits look if drawn on a ruler; at -1, they would have fallen accordingly. A zero, on the other hand, would indicate that there is no relationship between time and profits. In this case, profits seem to rise and fall arbitrarily.

I really don’t want to be in the business of forecasting dividends. I can really start with forecasting profit growth and then make dividend assumptions from there.

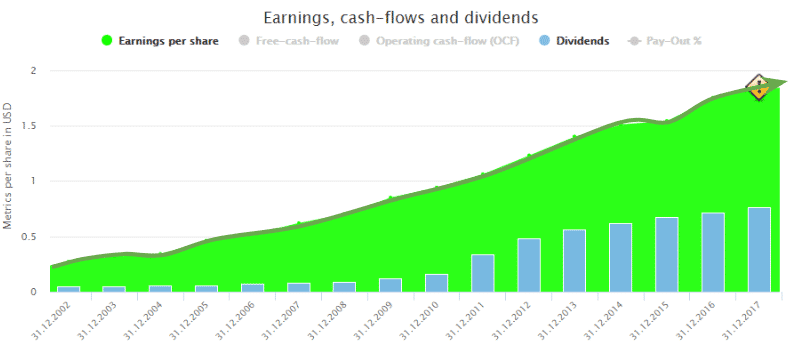

This is what a company with stable profits looks like:

Long-term profit-growth of Church & Dwight (CHD) with profit stability of + 0.98

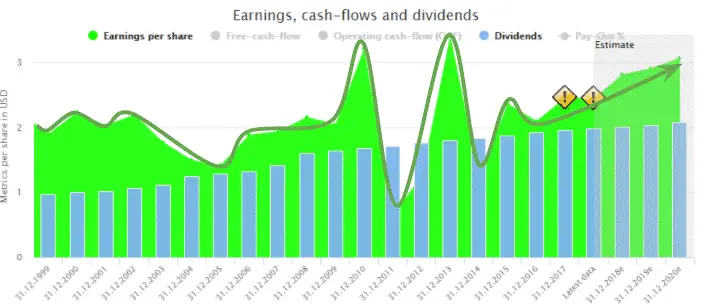

This is a company with lacking profit-growth stability:

Long-term profit-growth of AT&T (T) with profit stability of + 0.22

The example of AT&T shows that the title of dividend aristocrat does not necessarily imply stable profit-growth. And it is no coincidence that AT&T’s dividend increase of just over 2% per year is very low.

Moreover, it is hardly surprising that investment in Church & Dwight over the past 20 years has been much more lucrative than an investment in AT&T.

Combining profit-growth and profit-stability

The CAGR alone is unreliable because it ignores everything between the start and the end. This shortcoming is eliminated by the consideration of profit-stability. In the quest for companies with long-term profit-growth, investors should focus on companies with stable profit-growth, e.g. by filtering for companies with an earnings correlation greater than 0.8. The CAGR makes only sense for companies meeting such criteria.

The combination of profit-growth and profit-stability can be applied not only to earnings but also to other fundamentals such as operating cash-flows, revenues, and even dividends as well. In fact, dividend stability describes the reliability of dividends more accurately and universally than the number of years since dividends have been increased.

More accurately, the number of years is based on a simple Yes or No, while the stability of the dividend takes into account the actual dividend increase. Universally, because of the dividend aristocrats, or the number of years of a dividend increase in general, are a US construct. Outside the US, for example in Germany, dividends are more closely linked to current earnings.

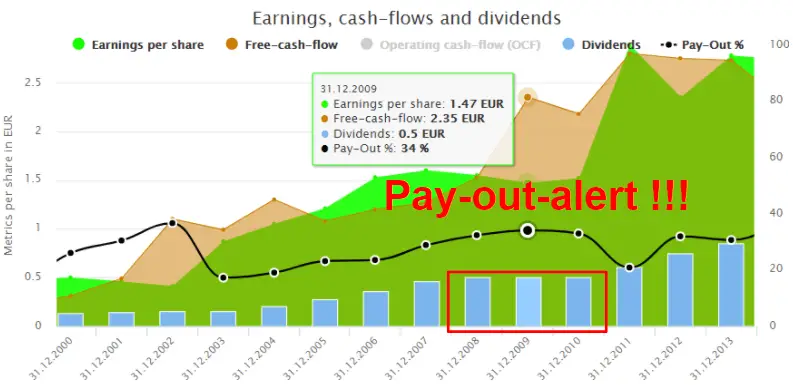

For example, during the financial crisis, SAP did not shy away from merely keeping the dividend constant and has therefore only increased it for 8 years.

Nevertheless, with a dividend correlation of +0.98, SAP has a more stable dividend history than many dividend aristocrats, because their dividend increases were more uneven than those of SAP – even though their dividends were kept constant twice as a result of the Financial Crisis in order not to exceed the 35% payout ratio valid at this date.

Dividend history of SAP with a dividend stability of + 0.98

Pair your findings in growth with what the company looks like in its current financial statements.

Combining profit- and dividend-growth

Rather than primarily evaluating the quality of a dividend stock using the dividend history, I prefer a two-pronged approach that takes into account the performance of profits and dividends as well.

As an ESG investor, I do not consider companies with either unstable profit-growth or dividend payments and that do not meet my thresholds for sustainability. To me, these two requirements are universal.

Each investor can decide for himself whether he also wants to apply classic metrics such as years of a dividend increase or pay-out-ratio. Depending on your investment strategy, you may also want to determine a minimum dividend yield, consider the current valuation of the stock or look at liabilities in the balance sheet. As equity investors, you are the lowest on the capital stack. You get remaining profits after everyone else.

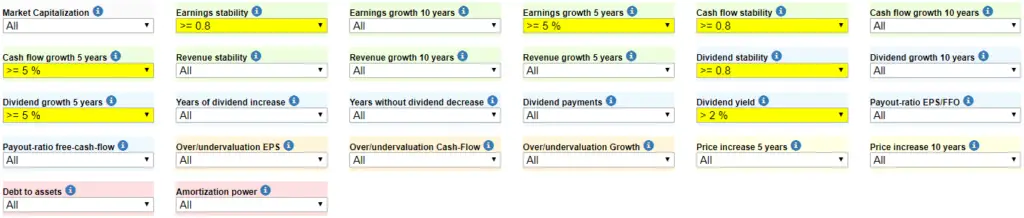

A search for promising dividend stocks could look as follows:

The filters on earnings and cash flow stability of at least 0.8 are combined with an increase of earnings and operating cash flows of at least 5% over the last 5 years. Only companies with stable profit-growth remain. In addition, dividend-based criteria are defined. You can follow my exact criteria for finding undervalued dividend stocks.

In this example, their conditions closely match those related to profits. Furthermore, the example filters for stocks with a current dividend yield of more than 2%. Other criteria such as the number of years of dividend increase, debt or valuation are not considered.

Conclusion: Dividends Start with Profit Growth

Dividends are not compensation for pain and suffering. They should neither compensate for an unsatisfactory profit-growth nor compensate for capital losses but should grow in line with growing company profits and capital gains. Volatile stocks actually create great opportunities. You just need to understand profit growth. You’ll be finding diamonds in the rough in no time.

To achieve this, the long-term profit-growth of a company should be considered when selecting stocks. This can be done by combining profit-growth and stability. Consider some of these best dividend investing books to expand your knowledge.

Do you feel comfortable in analyzing profit growth? Please let me know in the comment below. I’d love to hear from you!

Related Resources:

- List of Dividend Kings to Help You Invest

- 6+ Ways to Get Free Stocks Now

- Free Downloadable Dividend Discount Model

Subscribe to the Millionaire Mob early retirement blog newsletter to find the best travel hacking tips, dividend growth investing, passive income ideas and more. Achieve the financially free lifestyle you’ve always wanted.

Follow me on Facebook, Twitter and Instagram.

The post The Secret to Dividend Investing is Profit Growth [Here’s Why] appeared first on Millionaire Mob.

from Millionaire Mob http://bit.ly/2sWwobJ

via IFTTT

No comments:

Post a Comment