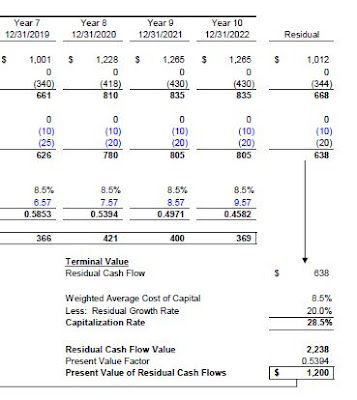

Below, you will see my 10 year DCF using the median analyst forecasted EBITDA projections. I used a WACC of 8.5% after careful consideration of the Company's risks, capital structure, and industry trends.

Several studies on mid-stage biotechs indicate a 7.5% WACC is reasonable I gave an extra 100 bps premium due to the inherent risks associated with the Company (Anchor approval, NCE, etc.)

I indicated a -25% residual growth rate after year 10 due to the Company's upcoming product exclusivity (patent exprirations begin in a few fiscal years, thereafter).

Now for the concluded PT, after taking in consideration of the $100 million non-equity financing announced yesterday, and a projected Warrant Liability of $100 million by the end of the year and the Company's current cash and debt amount from the September 30, 2012 balance sheet. I have concluded that a FMV of Equity $3.0 billion seems to be fair and a PT of $20 per share (as seen below).

Ok, now for the fun part, lets assume the Company has a pretty successful launch and bids for the Company come flying in, which could easily happen. I have assumed a very conservative 60.0% premium for control, which is the average premium for Biotech company since fiscal 2007. Personally, I believe Amarin could yield 70-75%.

Ok, so really its not hard to find the true value in Amarin. Yes, there is a lot of uncertainty out there, but bear with it. Don't let a day like today fool you about the true prospects of a drug, were all in it for the long haul so "bear" with it.

Good analysis however you are way off on the fully diluted shares outstanding. With the convertible bond, warrants and the latest round of options awarded to insiders, it is closer to just over 184 million shares outstanding. That brings your price model down significantly.

ReplyDelete