The capitalization rate is an important metric for commercial and residential real estate investing. Here our guide on how to calculate a cap rate.

How to Calculate a Cap Rate: Make Money with Real Estate

Real estate investment is a very lucrative venture. However, it can be pretty tricky because of some hidden dangers and unforeseen market forces that can bring down a seemingly great real estate investment. I’ve been tracking my real estate holdings through Personal Capital.

Personal Capital added Zillow house value to the real estate component and I love it!

Personal Capital shows my exact net worth over time with real estate added in for free. Plus, I’m able to track income property cash flow as well.

Real estate should be in everyone’s asset allocation for building wealth. It is one of the few asset classes that provide increased income AND capital appreciation at the same time. In the stock market, I’ve been investing in dividend stocks that feature similar characteristics.

I created a book titled Dividend Investing Your Way to Financial Freedom to help you increase your income and build wealth at the same time.

If you want a sample of the book, you can download it here.

Combining both dividend investing and real estate can be a great way to invest your money. Here are several other tips on how to invest money to allocate your assets.

It is crucial thus to have the right calculation and tools to help you fully understand the value of your investment. Calculating cap rate is one of the best ways for an investor to know the position and the return on investment. As an investor the higher the cap rate the better. That could mean more risk. Here are several other real estate risks to consider before investing.

With proper calculations, you can understand the costs and potential gains of your real estate investment. It is essential to understand everything about the capitalization rate or cap rate of a given property to accurately estimate the profitability of the investment. In this article, we will look at how to calculate a cap rate.

So, to understand more about calculating cap rate in real estate, let’s first look at what cap rate means.

What Does Capitalization Rate (Cap Rate) Mean?

Cap rate is expressed as the ratio of the property’s net income to the value of the property or the purchase price of the property which is then multiplied by 100. The ratio is an analytical metric that is used to determine real estate property’s profitability, and to enables the investors to compare the viability of two or more pieces of property.

Just like other financial ratios, you need to use this metric to be able to help you make a conscious investment decision.

There are several ways to calculate the cap rate, but in this article, we will specifically look at calculating the cap rate from NOI (Net Operating Income).

Steps on How to Calculate a Cap Rate in Real Estate

To calculate the cap rate, you can use the cap rate calculator for rental property. But, you will first need to have both the NOI and the current market value of the property. Here are the three necessary steps to follow when calculating the cap rate:

-

The first step is that you will need to figure the annual gross income of the investment property.

It involves adding up all the revenues the property generates yearly. In a majority of cases, the gross income includes the rental income that you will receive from the tenants. It may not be the only possible source of income because you may also accrue revenues from other sources such as income from a vending machine, a parking lot, and other additional income the property generates.

Gross income is all the income collected per month which are then multiplied by 12 (months) to get the annual gross income.

-

The next step is to subtract all the yearly operating expenses that are associated with the property from the annual gross income.

Some of the operating expenses of an income property include:

- Property management fees: Property agencies may manage the property, and thus you may be charged property management fees which usually can range from 8% – 25 % of gross income.

- Taxes: The tax rates differ with location, property size, and value.

- Insurance: It involves the premiums paid to insure and protect the property from loss of income, damage and perils from fire and other weather-related damage. Things like a home warranty plan can help protect your home appliances in the first few years of ownership.

- Maintenance and repairs: It includes all the costs associated with making repairs or maintaining the property and can consist of painting, pest control, and lawn care among other necessary repairs.

- Miscellaneous expenses: The miscellaneous costs can include such costs like accounting, legal fees, common area utilities and more.

It is vital to note that the cap rate doesn’t include the business expenses of the property such as the property’s’ purchase costs, mortgage payments among other fees. These costs are variable and usually reflect the investors’ position with the lender.

-

The last step is to divide the net income by the current value or the purchase price of the property.

Cap rate is the ratio between the net income and the current value or price of the property and is expressed as a percentage. It is important to note that the current value of the property is preferred to the purchase price because the property price appreciates with time unless you’ve just purchased the property. So, when calculating the cap rate, use the current fair market value (FMV) which is usually the value of the property on the marketplace.

Cap Rate = (Net Operating Income/Current Market value of the property) x 100

Cap Rate Calculation Example

Let’s look at an example to help us understand how to calculate a cap rate. Example of calculating the Cap Rate:

For example, let’s say there is a house whose rent is at a rate of $650/month. The gross income of the property will be 650 × 12 = $7,800 per year.

If the property associated costs include $800 in property management, $610 in taxes, $350 in maintenance, and $550 in insurance per annum for the property. 7,800 – 800 – – 610 350 – 550 = $5,490, will be the property’s net income.

Let’s say the property current value is $30,000. Given the information, we have calculated above we can now find our cap rate:

$7800 (gross income)

-$800 (property management)

-$610 (taxes)

-$350 (maintenance)

-$550 (insurance)

=$5,490 (net income) / $30,000 (purchase price) = 0.183 = 18.3% cap rate

Let’s now look at the importance of the cap rates to the real estate investor.

The Importance of Capitalization Rate

The cap rate is a very important metric for real estate investing. Here are several reasons why the cap rate is such an important metric.

-

It helps compare different investment opportunities.

The cap rate is mainly used to compare between two or more investment opportunities. For instance, when everything else remains constant, if an investor has two assets where one property has a 10% cap rate versus another property that has 3.5%, the investor will most likely focus on the asset with a 10% cap rate.

Cap rate is an important metric that helps compare the profitability of different investment opportunities. However, it is not the only analytical metric to consider. It is vital to understand that different cap rates represent different risk levels. A higher cap rate implies a higher level of risk whereas a lower cap rate implies lower risk.

So, there is no optimal cap rate, and it all depends on what the investor prefers. Sometimes the investor’s preferences may be based on the geographical location of the asset. The assets must be the same type of property and in similar geographic areas to be able to compare or contrast the cap rates of two or more pieces of property.

Conduct your own due diligence of course. You want to find opportunities that have a very high cap rate, but are low risk.

-

It indicates the amount of time it would take to recover the entire investment.

The cap rate also helps indicates how long it would take to recover your investment from an asset. For instance, if an asset has a cap rate of 10%. It would take approximately ten years for the investor to be fully capitalized or recover their investment.

-

You can use the cap rate as a way to determine an offer price

Using simple math you can use the cap rate as a way to determine your offer price for a commercial or residential income property. For example, if you know your net operating income and have a preferred cap rate you use it to determine market price.

If your net operating income is $100,000 and you want to achieve a 10% cap rate, you simply take $100,000 dividend by a 10% cap rate. This equals a $1,000,000 offer price for the income property. An appraiser will likely use a cap rate to determine value or at least look at comparable cap rates for similar buildings. Here’s an appraisal checklist to consider for preparing your sale or purchase.

What are realistic cap rates?

A cap rate is definitely not a one-size-fits-all approach. A cap rate can vary depending on the sector within real estate and the location. In a recent article from CrowdStreet, they reference how investment groups vary based on the location.

Here is how CrowdStreet broke it down:

“For example, that same investment group can spend that $20 million to buy the Los Angeles apartment building at a 5% cap rate. Or, it may consider spending $14 million to buy a shopping center in Kansas City at a 7% cap rate and the remaining $6 million to buy an industrial building in Minneapolis at a 6.5% cap.

There are a number of other factors that go into those real estate decisions, but on a purely numbers basis, the investment group can weigh the pros and cons of buying one asset in a top market that will deliver a 5% return, or buy two different assets in smaller cities with a higher blended return of 6.85%.”

As an investor, you need to think of it, in the same way, no matter if you are investing in residential, hotels, office, etc. A cap rate for a hotel investment in New York would be a lot different than a cap rate for a residential property in Omaha, Nebraska.

Investing in hotels is a lot easier than you think. Here is how anyone can start investing in hotels.

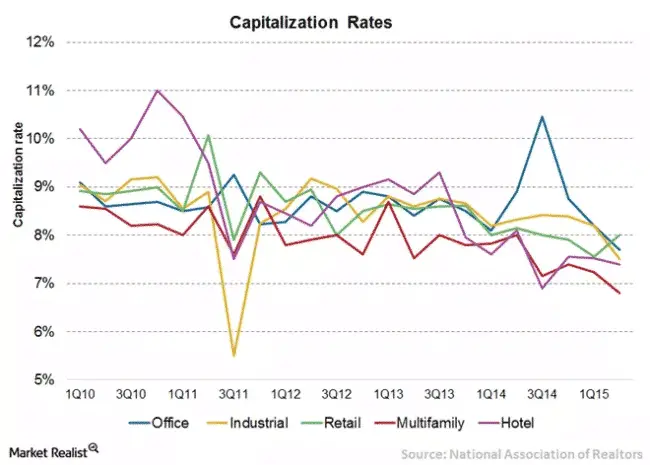

Cap Rates by Real Estate Segment

Here is a breakdown of the capitalization rates by segment over time.

Conclusion on How to Calculate a Cap Rate

In today’s age, there are plenty of ways to invest in real estate. You can easily do so through investing in properties directly, through REITs, stocks and real estate crowdfunding.

I use CrowdStreet, which offers me some of the best of breed investment opportunities in real estate that I can’t find elsewhere. I’m able to invest in commercial real estate and other opportunities across the United States.

The calculation of cap rate can help you become a smarter investor. Calculating cap rate is essential because it is one of the analytical tools that can help a real estate investor to assess the profitability of a residential or commercial investment property. I hope this guide will help you determine whether a specific real estate investment will be a viable option or not.

Do you know how to calculate a cap rate? Please let us know in the comment below. We’d love to hear from you.

Other Related Investing Money Resources:

- Use these best robo-advisors to automate your passive income investments

- Our resources on how to invest money to ensure success

- How to use a 401(k) calculator to save on retirement fees

- A guide to living off dividends forever… What does it take?

Subscribe to the Millionaire Mob early retirement blog newsletter to find the best travel hacking tips, dividend growth investing, passive income ideas and more. Achieve the financially free lifestyle you’ve always wanted.

Follow me on Facebook, Twitter and Instagram.

The post How to Calculate a Cap Rate: Make Money with Real Estate appeared first on Millionaire Mob.

from Millionaire Mob http://bit.ly/2MeFnOf

via IFTTT

Hey!! This is such an amazing article that I have read today & you don't believe that I have enjoyed a lot while reading this amazing article. thanx for sharing such an amazing article with us.

ReplyDeleteProperty in Kalamboli below 50 lakhs