If you have a 401(k), you’ll likely want to use this guide to start saving retirement money on fees. My Alerus 401(k) was under-optimized. I instantly saved $3,120 in retirement fees. Here’s how.

How I Saved $3,120 Instantly on Alerus 401(k) Retirement Fees

Fees can erode your investment returns significantly. Especially if there are annual fees over a 20-30 year time horizon. I have a 401(k) retirement plan with Alerus.

You’ll likely want to follow the same guidelines for how to save money on retirement fees and start making your money work smarter. Alerus Financial is a well-regard financial institution and offers banking, mortgage, wealth management, and retirement services. I was happy to see that I could easily optimize my 401(k) using a retirement fee calculator.

In addition to my retirement goals, I’m on a mission to live completely off dividends. I created a dividend calculator that will help you develop a plan to live off dividends. Try downloading it using the button below. It only takes 5 minutes to punch in the assumptions.

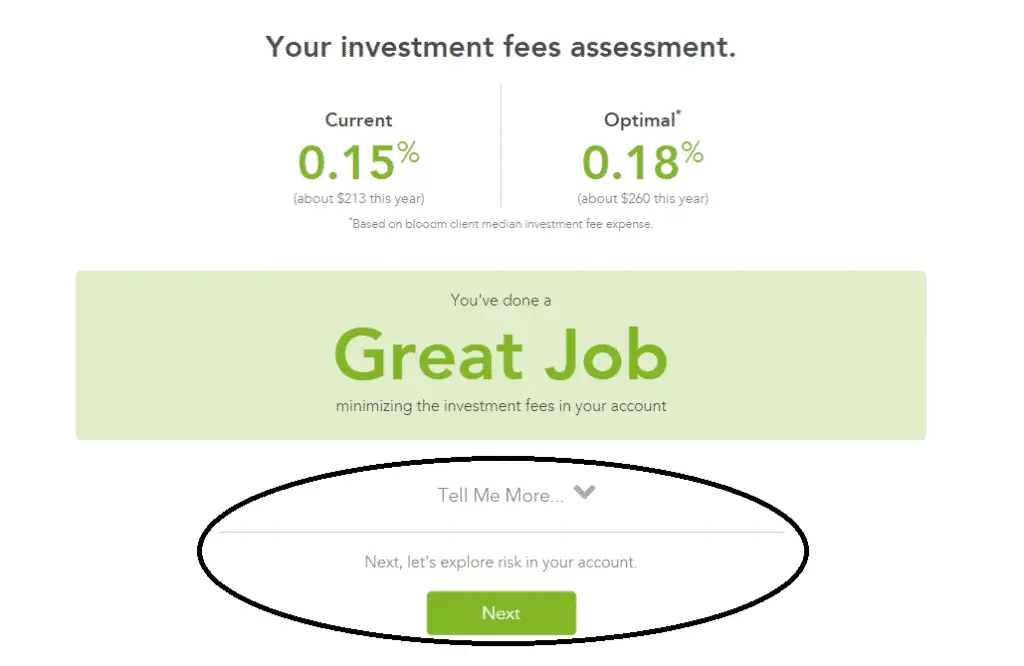

I had a total yearly fee of 0.30% in my 401(k) before optimizing and completely cleaning it up. This equated to approximately $416 per year in annual retirement fees. I was able to reduce it down to 0.15% or $213/year.

This saved me over $3,120 simply by optimizing my Alerus 401(k) without taking on more risk. Here’s how I did it.

Steps to Optimize Your 401(k) and Save on Retirement Fees

Below I will outline the exact steps to take to optimize your 401(k) and start saving money on your retirement fees. These are the exact steps that I took to save $3,120 by following these easy four steps.

Here are the exact steps to take to start saving money on retirement and 401(k) fees.

1. Use a 401(k) Fee Calculator and Optimizer

The first step that you need to take is to find out what you are truly paying in fees by using a 401(k) fee calculator such as Blooom.

I use Blooom because it has a simple interface and sleek design. The best part is that Blooom will give you a completely free optimization and guide you through the exact steps of where you are overspending on fees.

This will help you save money and make your 401(k) optimized. Blooom is a well-trusted analyzer of retirement plans with over $938 million in savings.

Get a free analysis using my link of your Alerus employer-sponsored retirement plan. Understand your investments at a high level and uncover unnecessary hidden fees.

You can read my Blooom review for a full overview of the platform.

Plus, it gives me the exact results that I need to make actionable decisions in my Alerus 401(k).

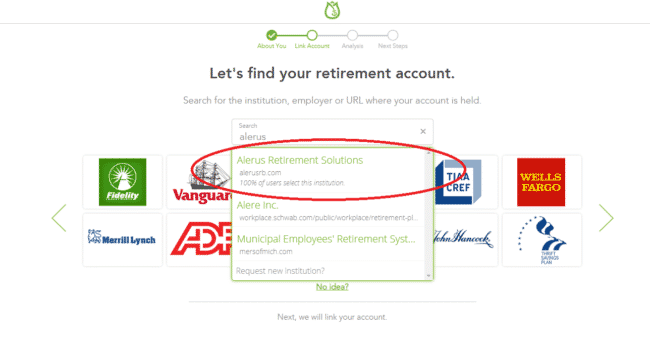

2. Start Linking Your Account

After signing up for Blooom, simply type in ‘Alerus’ in the search bar to start linking your account. You can see the dashboard below. Select the Alerus Retirement Solutions options. It should come up first on the list.

Once you have selected Alerus Retirement Solutions in the dropdown, Blooom will ask you to input your login information for your Alerus retirement account. This is a secure platform and Blooom is safe.

After you input your information, let Blooom work it’s magic!

3. Evaluate the Results

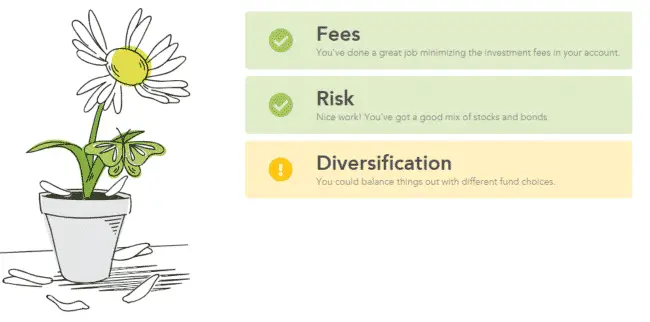

One thing I love about using Blooom is that I’m able to digest the results in three core aspects of my 401(k) and other retirement accounts.

The analyzer will break it down in three core categories:

- Fees

- Risk

- Diversification

Here is a snapshot of how my Alerus retirement account looks after linking it on the Blooom analyzer.

As you can see, I’ve optimized my 401(k) in a number of ways including fees and risk. I’ve selected only a handful of low-cost index funds in my account.

Fees Assessment

Now you can start optimizing your fees. For my Alerus 401(k), Blooom has no other tips for me to save money. I already did my job!

Use the ‘learn more’ section of the fees analysis to learn why saving on retirement fees is so important.

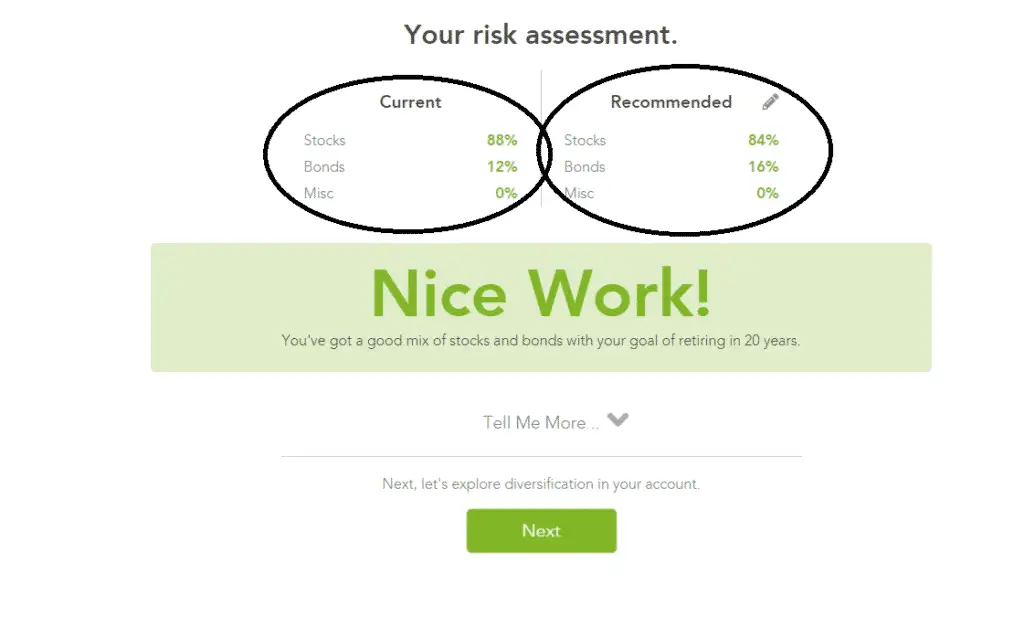

Risk Assessment

Blooom will conduct a full risk assessment of your 401(k) account. This will be fully complete based on your recommended amounts compared to your current.

My current allocation is balanced at 88% stocks and 12% bonds, which is slightly more aggressive than the recommended allocation of 84% stocks and 16% bonds.

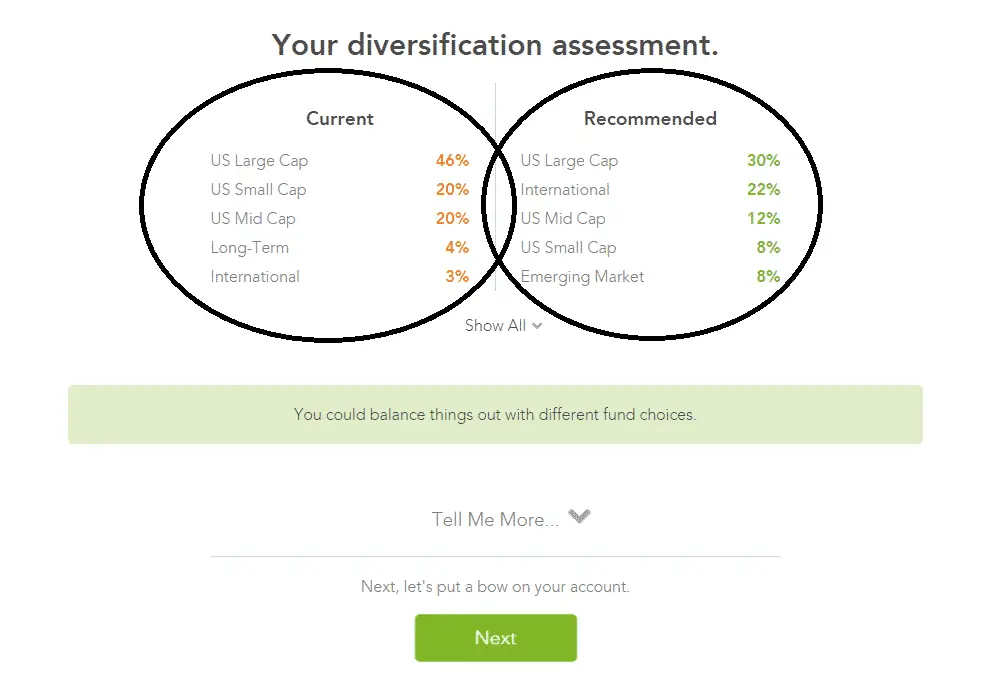

Diversification Assessment

My current diversification assessment shows that I need to improve it. My current allocation is more heavily weighted to large cap stocks at 46% allocation compared to a recommended 30%.

Also, I have probably too much exposure to small caps and not enough in my international allocation. However, in my mega backdoor Roth IRA I am heavily allocated to international stocks.

Good news! Blooom offers support for other retirement accounts including IRAs, Roth IRAs, and more. Make sure to link up those accounts to make sure that you have the complete picture.

4. Cross-Check Your Results with Retirement Forecasting

Bonus! There are plenty of other amazing financial tools that you can actually pair your Blooom analysis with. This will help you get a high-level picture of your investment status to guide your financial future.

Let’s all work smarter and not harder. All the while we can save significant sums of money, which equates to retiring earlier or paying for your child’s college.

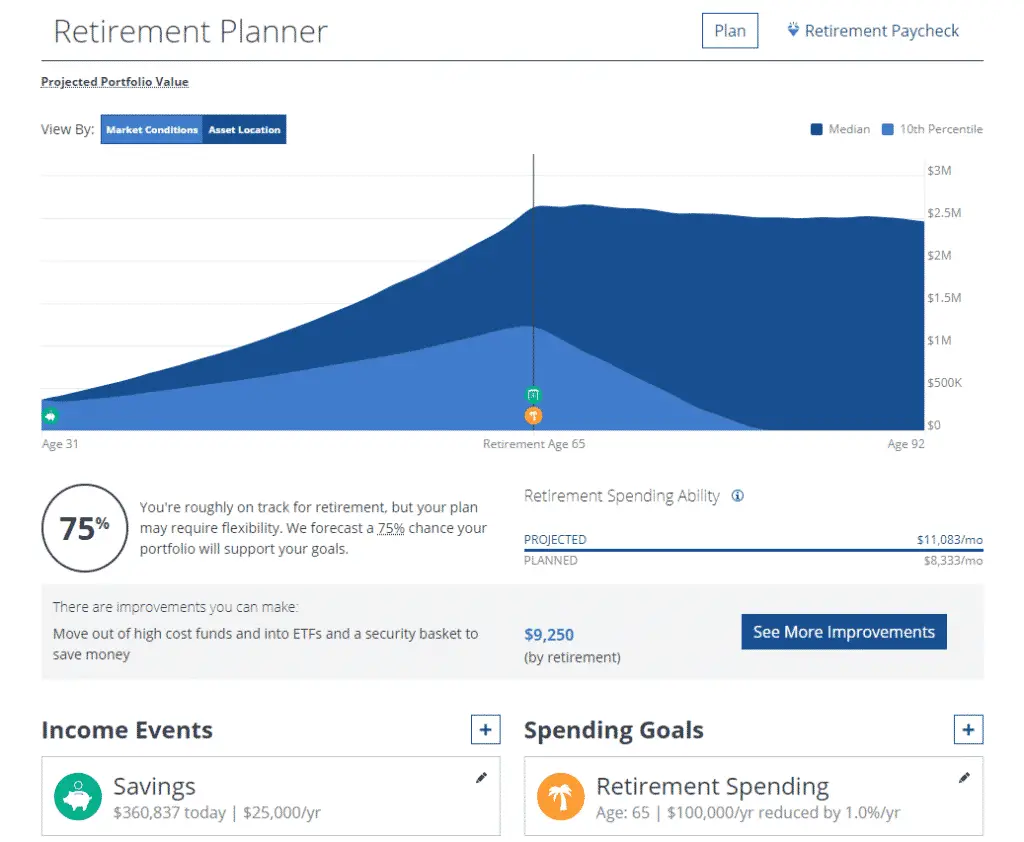

I love cross-checking my Blooom free analysis with Personal Capital’s retirement planning dashboard. Personal Capital is a complete cash flow, investment and money management tool that is completely free (and easy) to use.

By reducing my fees from my Blooom analysis, I am in significantly better shape for reaching my retirement planning goals.

I want to retire at 65 and still have a $100,000 income. Based on my free analysis with Personal Capital, I’m projected (with a 75% success rate) to have $11,083 per month in annual income.

Yeah, that’s the good news. Here’s the bad. I have a long ways to go to reach that goal…

I’m constantly looking to improve and Personal Capital allows me to do that. I click the ‘see more improvements’ button to get better actionable steps to make my money work smarter and harder.

How to Improve My Retirement Plan

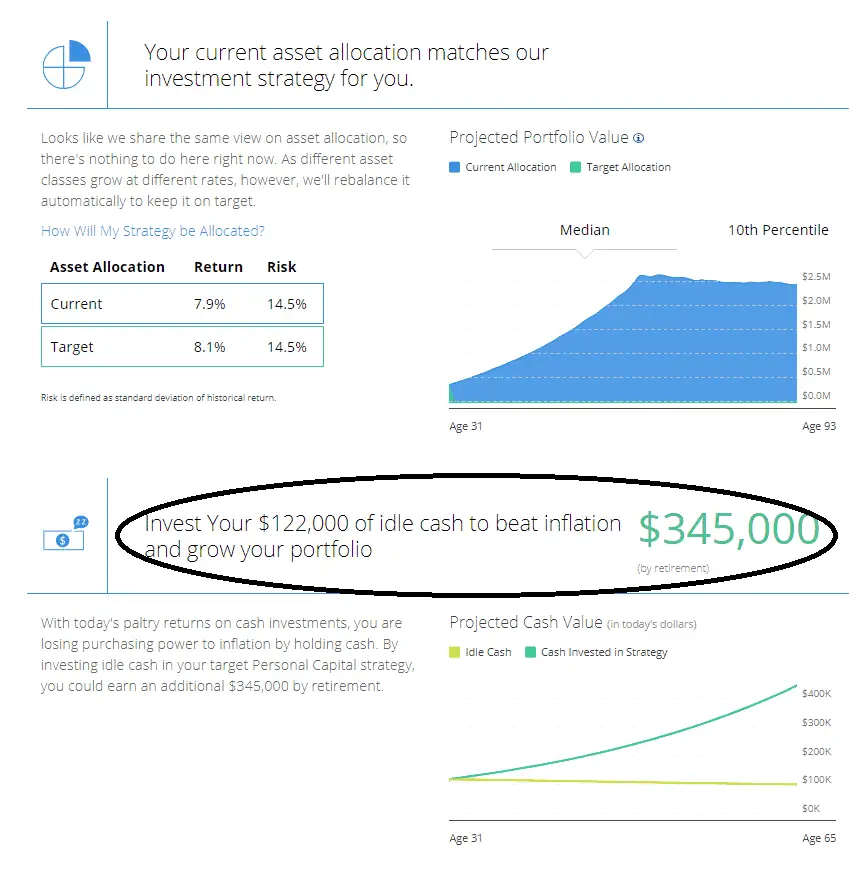

Personal Capital will give you some amazing advice about how to improve your retirement planning and portfolio… for FREE. Here is some amazing points on my dashboard.

- I match their current asset allocation recommendations

- There is too much cash on the sidelines that I need to put to work (insert income property here)

Take a look at my dashboard for yourself.

I need to find a way to put some more cash to work in my savings accounts. This will greatly help my retirement planning.

Why Saving for Retirement is Important

Retirement is crucial. People don’t take their retirement accounts serious enough. I’ve been fortunate enough to max out my 401(k) and Roth IRA contributions for the last few years. However, I still feel like that isn’t enough.

Here are some reasons why saving for retirement is crucial:

- We can’t rely on social security being there

- You work too hard to not have a favorable nest egg

- Tax advantages of retirement accounts are way too favorable to ignore

I suggest that you find ways to max out your 401(k) and IRA completely to the legal limits. If not, at least try to contribute the amount that enables your full employee match. Use our retirement readiness checklist to figure out if you are in a position to retire or not. There are plenty of other considerations for retiring outside of cash flow and expenses.

Conclusion on How to Save Money in Your 401(k)

By using the outlined tools of Personal Capital and Blooom, you shouldn’t have to hire a 401(k) advisor or pay additional money to make the most out of your retirement accounts.

I outlined an exact format for you to start saving money instantly. There is no reason to pay excess fees for no additional return. There are far too many funds that require additional fees, but do the exact same thing as low-cost index funds. There are plenty of other ways to use a retirement calculator to save money.

If you feel comfortable with your retirement accounts, more to a taxable portfolio. There are plenty of great brokerages out there… Even some that will give you free stocks just for signing up.

Will you start saving money in your 401(k)? Did you save money in your Alerus 401(k) by following my guide? Please let me know in the comments below. I’d love to hear from you.

Related Resources:

- Our resources on how to invest money to ensure success

- How to use a 401(k) calculator to save on retirement fees

- A guide to start investing your money… What does it take?

Subscribe to the Millionaire Mob early retirement blog newsletter to find the best travel hacking tips, dividend growth investing, passive income ideas and more. Achieve the financially free lifestyle you’ve always wanted.

Follow me on Facebook, Twitter and Instagram.

The post How I Saved $3,120 Instantly on Alerus 401(k) Retirement Fees appeared first on Millionaire Mob.

from Millionaire Mob http://bit.ly/2HlAggo

via IFTTT

No comments:

Post a Comment